Exploring 3 High Growth Tech Stocks In Australia

The Australian market is experiencing a cautious start to the year, with the ASX 200 expected to open slightly lower amid global uncertainties and a weakening Aussie dollar, reflecting broader concerns about economic data and interest rate projections. In this environment, identifying high-growth tech stocks requires careful consideration of factors such as innovative potential and resilience in fluctuating market conditions.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Infomedia | 6.77% | 20.97% | ★★★★★☆ |

| Clinuvel Pharmaceuticals | 21.38% | 26.16% | ★★★★★☆ |

| Pureprofile | 14.31% | 71.53% | ★★★★★☆ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| AVA Risk Group | 25.54% | 77.32% | ★★★★★★ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Mesoblast | 46.67% | 53.70% | ★★★★★★ |

| Wrkr | 37.21% | 98.46% | ★★★★★★ |

| Opthea | 52.73% | 63.45% | ★★★★★★ |

| SiteMinder | 18.83% | 60.68% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our ASX High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Growth Rating: ★★★★★☆

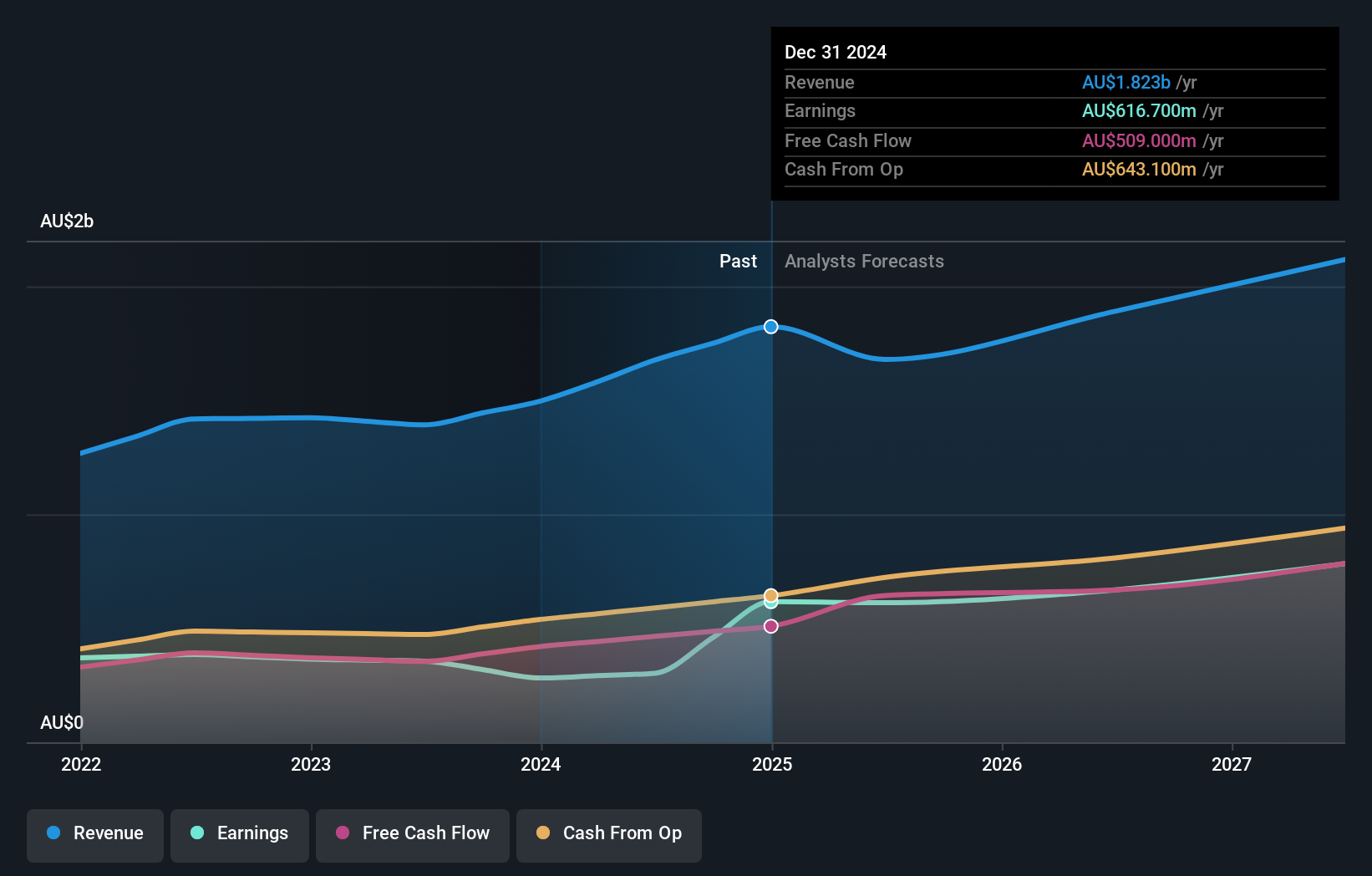

Overview: Clinuvel Pharmaceuticals Limited is a biopharmaceutical company that develops and commercializes treatments for genetic, metabolic, systemic, and life-threatening disorders across Australia, Europe, the United States, Switzerland, and internationally with a market cap of A$602.36 million.

Operations: Clinuvel Pharmaceuticals generates revenue primarily from its biopharmaceutical sector, amounting to A$88.18 million. The company focuses on developing and commercializing treatments for various disorders across multiple regions.

Clinuvel Pharmaceuticals, with its innovative approach to treating vitiligo using afamelanotide combined with NB-UVB, recently highlighted this during a special call on December 23, underscoring its commitment to addressing niche medical needs. The company’s financial health is robust, evidenced by a revenue growth rate of 21.4% annually, outpacing the Australian market average of 5.9%. Furthermore, Clinuvel’s earnings have surged by 16.4% over the past year and are projected to grow at an impressive rate of 26.2% annually over the next three years. This growth trajectory is supported by substantial investments in R&D and strategic conference presentations aimed at bolstering investor relations and stakeholder engagement as demonstrated at the Bell Potter Healthcare Conference on November 18. These factors collectively underscore Clinuvel’s potential in both medical innovation and financial performance within Australia’s high-tech biotech scene.

ASX:CUV Earnings and Revenue Growth as at Jan 2025

Simply Wall St Growth Rating: ★★★★☆☆

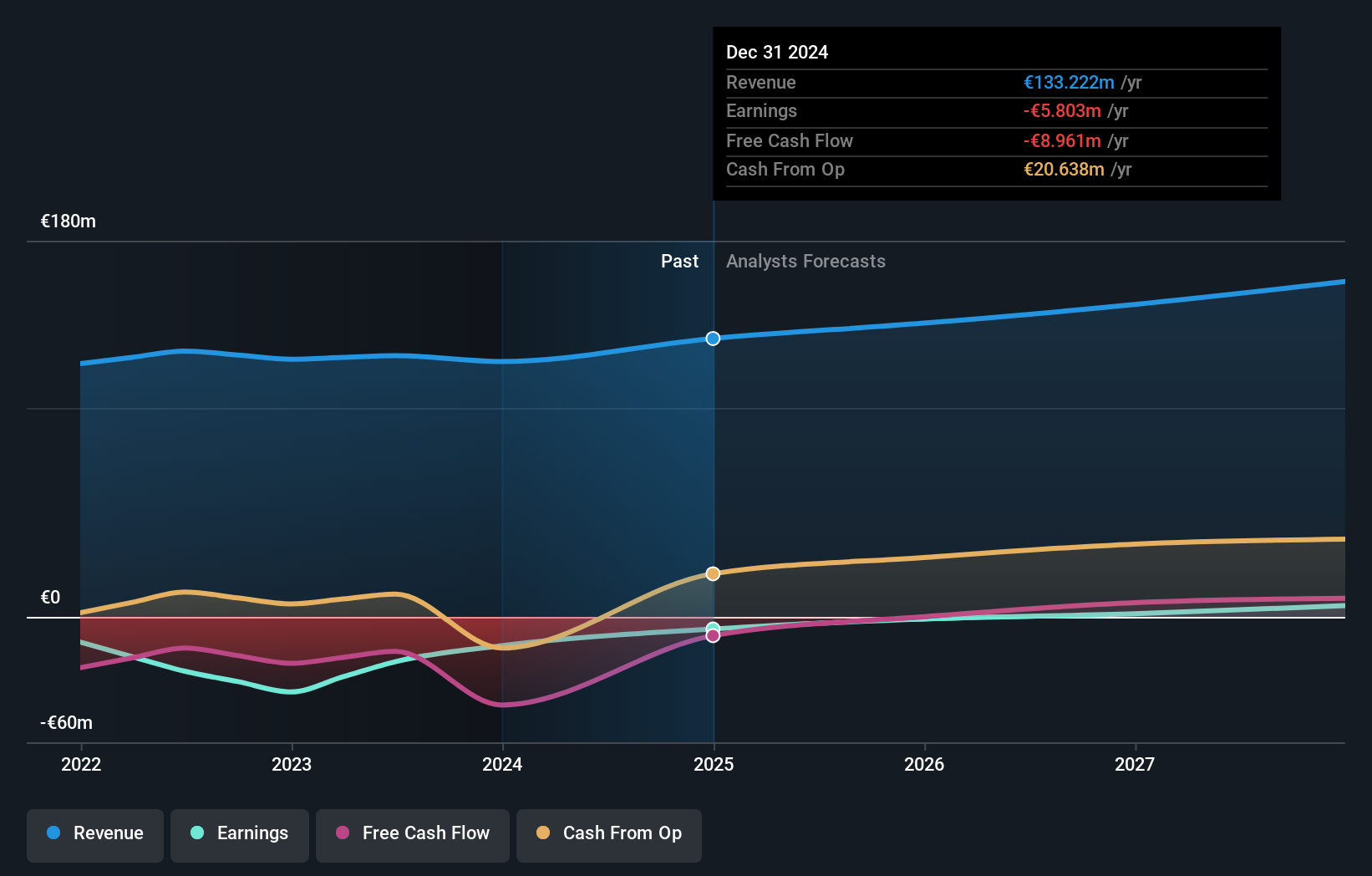

Overview: FINEOS Corporation Holdings plc develops and sells enterprise claims and policy management software for the employee benefits and life, accident, and health insurance industries globally, with a market cap of A$622.51 million.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to €122.24 million. It operates within the global insurance sector, focusing on providing enterprise solutions for claims and policy management in employee benefits and life, accident, and health insurance industries.

FINEOS Corporation Holdings, amid the competitive landscape of Australia’s tech sector, is strategically positioning itself for growth. The company recently launched the FINEOS Partner Hub, enhancing service offerings and customer experience through a network of curated partners integrated with its platform. This move aligns with its 6.1% annual revenue growth forecast, outpacing the Australian market average of 5.9%. Despite current unprofitability, FINEOS is expected to see earnings soar by an impressive 73.9% annually over the next three years due to strategic expansions and innovations like this hub which cater specifically to evolving needs in employee benefits solutions.

Simply Wall St Growth Rating: ★★★★★★

Overview: Mesoblast Limited is involved in the development of regenerative medicine products across Australia, the United States, Singapore, and Switzerland with a market cap of A$3.54 billion.

Operations: The company focuses on developing regenerative medicine products, generating revenue primarily from its cell technology platform aimed at commercialization, which brought in $5.90 million.

Amid recent strategic advancements, Mesoblast Limited has demonstrated significant potential within the biotechnology sector. The company’s inclusion in the NASDAQ Biotechnology Index and successful follow-on equity offerings underscore its financial agility and market confidence. Notably, Mesoblast’s RYONCIL® (remestemcel-L), approved by the FDA, marks a pioneering achievement as the first mesenchymal stromal cell therapy in the U.S., targeting severe graft versus host disease in children—a niche yet crucial medical need. This approval could herald new growth avenues for Mesoblast, with R&D expenses aligned to propel these innovative therapies forward, ensuring sustained investment in life-transforming treatments.

Taking Advantage

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]